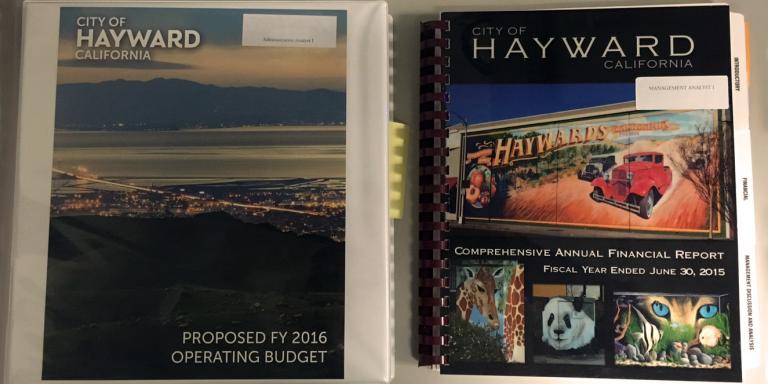

Your guide to finding the right office or department during your visit.

Our organizational chart outlines the different departments and their locations, making it easier for you to locate the right place to address your needs efficiently. Whether it's paying utility bills, getting permits, or seeking information, we're here to help you find your way around City Hall.