General Fund Budget FAQ

Over the last five months, the City of Hayward has been working diligently to understand the causes of and find solutions for a structural deficit in our General Fund that pays for most non-utility-related municipal services.

We have looked at decisions that contributed to the deficit, identified budget and fiscal practices that needed shoring up and ways to reduce spending and bolster revenues in the short term while beginning work on more structural change—change in how we serve the Hayward community that will be necessary to restore our financial stability and sustainability.

Some the steps we have taken in the short term include our elected and executive leadership accepting decreases in pay, holding vacant most unfilled staff positions, adjusting staffing models to control overtime expenses, cutting spending on supplies and other non-personnel expenses and inviting our City employee labor groups give back a share of recently negotiated salary and benefit increases.

The Frequently Asked Questions and related information that follows is intended to help you better understand the General Fund, contributors to the fiscal urgency we found ourselves in at the start of the current fiscal year and what we are doing to close the deficit and restore fiscal stability and sustainability.

What is the issue?

The City faces a multimillion-dollar deficit in its General Fund for the current 2026 Fiscal Year that began July 1, meaning expenditures are exceeding projected revenue. As of last month, the General Fund deficit for the current fiscal year was $26.4 million—with $246.3 million in projected total spending against $219.9 in total projected revenue. Essentially, the City General Fund operations are running in the red by $500,000 per week on average. The City is now taking immediate action to address this financial situation and bring the General Fund into balance by the end of the fiscal year.

What is the City of Hayward General Fund?

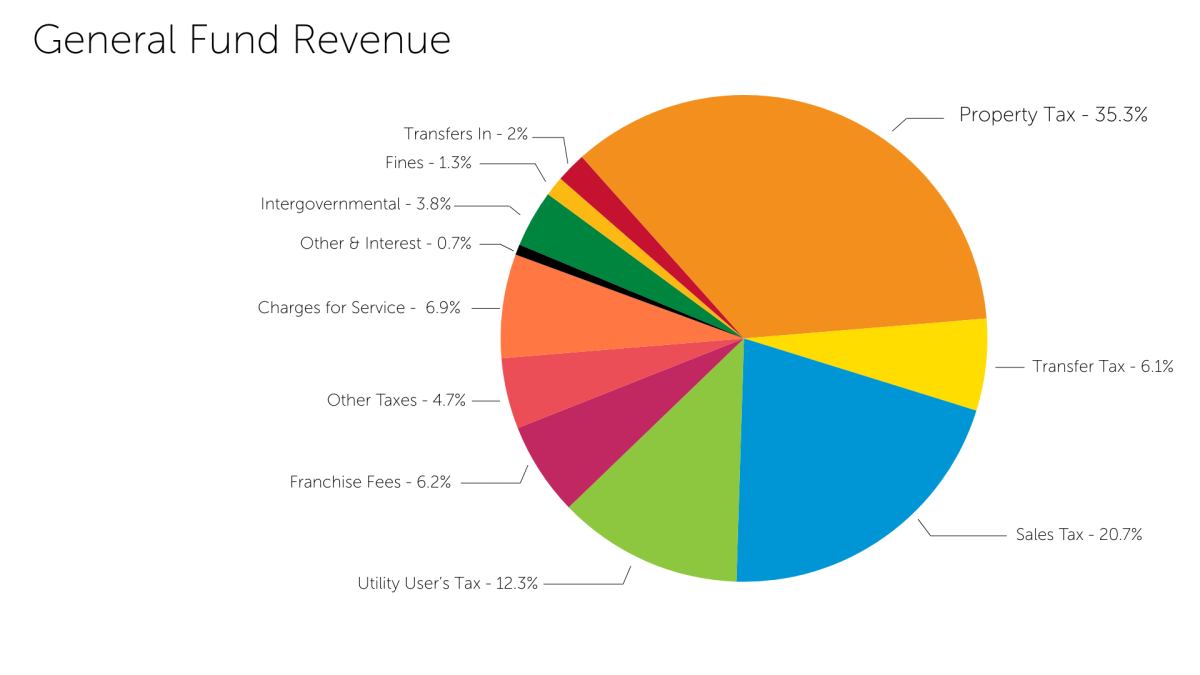

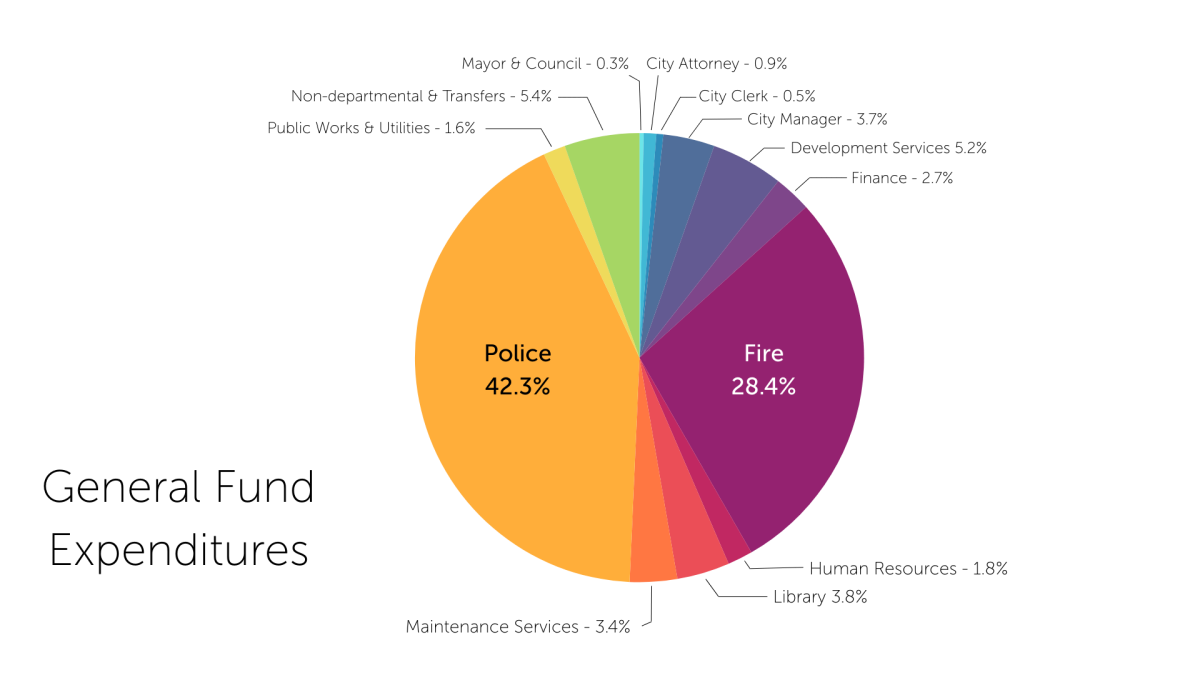

The General Fund is the City’s main operating fund and pays for most non-utility municipal services, primarily police, fire protection and emergency medical response services. Other City funds are managed separately from the General Fund and are primarily associated with the City’s Capital Improvement Program, water utilities and Hayward Executive Airport.

What is the General Fund reserve?

Fiscal policy established by the City Council calls for maintaining a 20-percent General Fund reserve as a cushion to get through economic downturns, emergencies and other temporary cost and revenue swings.

What is the cause of the General Fund deficit?

The General Fund deficit in the current 2026 Fiscal Year reflects an overall structural imbalance between annual General Fund revenue and the cost of General Fund operations. The gap between the two is projected to grow year over year, if the we do nothing to address the structural deficit.

How did the imbalance and deficit become such an urgent matter?

Over the past two fiscal years, General Fund spending exceeded General Fund revenues by tens of millions of dollars and effectively wiped out the entire General Fund reserve by the start of the current 2026 Fiscal Year on July 1.

As a result, immediate actions are now being implemented to bring budgeted General Fund spending into line with projected General Fund revenue. While certain actions have already been taken, as of Nov. 18, the projected General Fund deficit in the current fiscal year was $26.4 million.

What drove the spending increases the last two fiscal years?

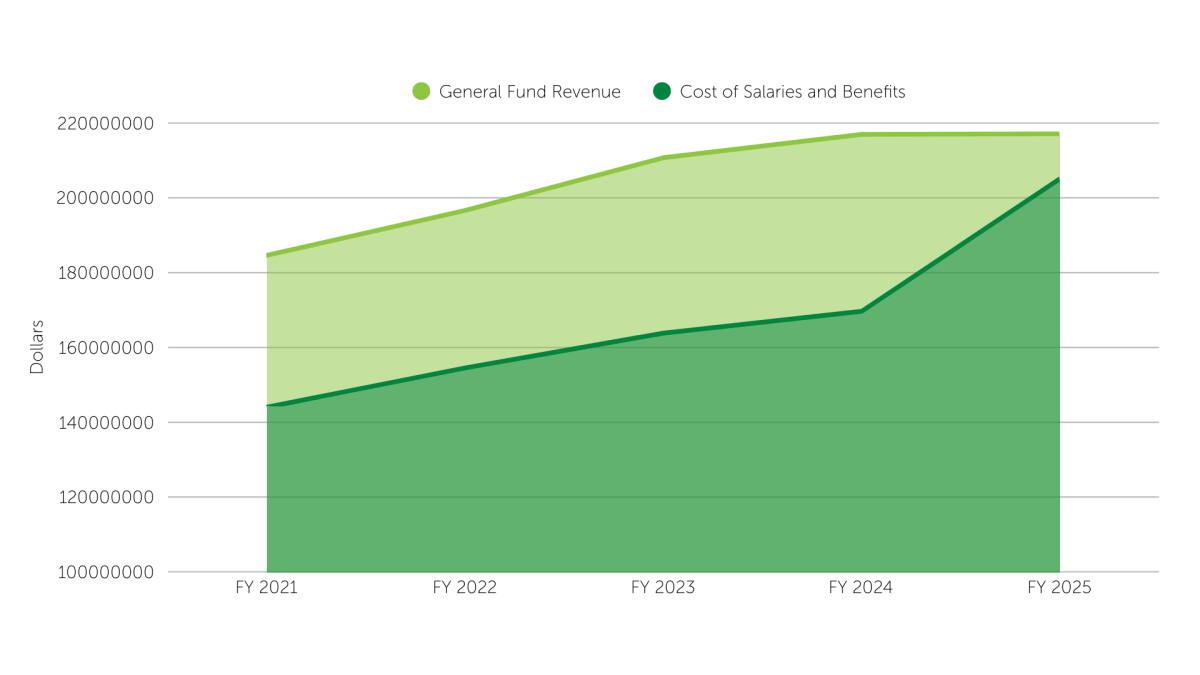

There are multiple factors that have influenced increased spending over the last two fiscal years, including rapidly increasing employee salaries and benefits based on compensation agreements approved in 2023 and 2024, new programs added during COVID, slowing revenues, and rising insurance and health care costs. Between Fiscal Year 2023 and Fiscal Year 2025, actual annual spending on salaries and benefits increased $41.3 million, or 25 percent, from $163.8 million in FY 2023 to $205.1 million in FY 2025. Meanwhile, over the same period, total General Fund revenue rose by just $6.4 million, or 3 percent, from $210.7 million in FY 2023 to $217.1 million in FY 2025.

Looked at a different way, total General Fund spending on salaries and benefits grew from the equivalent of 78 percent of total General Fund revenue in FY 2023 to the equivalent of 94 percent of total General Fund Revenue.

General Fund Summary - Actuals

Actual | FY2025 Unaudited | FY2024 | FY2023 | FY2022 |

|---|---|---|---|---|

| Salaries | 129,439,218 | 106,001,538 | 98,315,582 | 93,367,419 |

| Benefits | 75,681,922 | 63,676,556 | 65,526,167 | 61,182,155 |

| Salaries & Benefits Charge Out | (6,541,155) | (3,962,605) | (5,336,075), | (4,167,698) |

| Maintenance & Utilities | 1,651,932 | 1,775,132 | 1,091,858 | 1,209,681 |

| Supplies & Services | 13,373,763 | 14,975,982 | 12,604,727 | 10,653,686 |

| Internal Service Charges | 18,784,536 | 19,999,469 | 16,812,770 | 14,889,954 |

| Transfers Out | 15,314,128 | 14,895,302 | 16,796,034 | 17,069,643 |

| Total Expenses | 247,704,345 | 217,361,374 | 205,811,063 | 194,204,841 |

| Total Revenue | 217,140,279 | 216,969,339 | 210,724,488 | 196,625,348 |

Why did the City agree to new pay levels and benefits it couldn't afford?

The City Council approved new labor agreements negotiated and recommended by former executive leadership that, along with General Fund revenue projections, did not receive an adequate level of internal analysis and review.

How did the purchase of the Cinemark Cinema Building impact the General Fund?

The purchase of the Cinemark Cinema Building on B Street, which took place in January 2024, was carried out through an $8.6 million loan from the General Fund, effectively reducing the General Fund reserve by an equivalent amount. So, it significantly contributed to the depletion of the General Fund reserve by the start of the current 2026 Fiscal Year on July 1.

What is the City doing to close the General Fund budget deficit in the current 2026 Fiscal Year?

We are taking a balanced approach focused on increasing revenue—both from one-time and ongoing sources—and cutting spending on employee salaries and benefits, which accounted for 83 percent of total General Fund expenditures in Fiscal Year 2025, as well as reductions in services and supplies, and other cost saving measures.

On the revenue side, we are identifying and working to sell surplus City property. In addition, the City Council is considering increasing the rate of the Hayward Transient Occupancy Tax (TOT), also known as the hotel tax, from 12 percent to 14 percent, as authorized by voters with the passage of Measure NN in November 2020.

We also are evaluating updating fees for certain services and exploring a potential ballot measure in 2026 to raise the Hayward business license tax.

Lastly, the City Council has authorized the City Manager to redirect revenue from the City’s special Measure C ½-cent sales tax fund to support General Fund operations.

On the spending side, the City is asking employees to give back a portion of recent salary increases and accept other contract adjustments that would result in a net savings in personnel costs. Additionally, the City is making staffing and shift changes at the Hayward Fire and Police departments that are expected to save millions of dollars in overtime expenses annually.

In December, the City offered a Voluntary Separation Incentive Program to encourage employees to retire or leave City employment earlier than planned. And the City is holding vacant most unfilled positions that are paid for out of the General Fund. To the extent additional savings are needed, the City is preparing to lay off employees to further reduce salary and benefit costs.

What is the City doing to address its underlying structural imbalance in the General Fund?

Given the scale of the current deficit and structural imbalance, it will likely take years to return the City to a state of fiscal stability and sustainability. Not only does total spending need to be brought into line with total revenue, but a 20-percent General Fund operating reserve must be restored to bring the City back into compliance with the Council-established fiscal policy.

In addition to longer-term adjustments to boost overall revenues, Hayward city government likely also needs to operate with fewer employees, which will require re-evaluation and re-prioritization of services and an associated reorganization of staffing and changes in the way the City delivers services.

Questions? Leave your questions or comments about the budget below.

Related Documents

- Staff Report City Council Meeting: Nov. 18, 2025 - Budget Update and Adoption of Amendments to the City of Hayward’s FY 2025-26 Operating Budgets and Updates to Other Capital and Operating Budgets as Needed

- Presentation Budget and Finance Committee Meeting: Oct. 15, 2025 - Ten Year Budget-to-Actuals Financial Data for the General Fund and Measure C.

- News Release: Sept. 23, 2025 - Hayward’s Mayor, Councilmembers, Executive Team agree to take pay cuts

- News Release: Aug. 29, 2025 - Vacancy management and other measures in store to restore Hayward’s fiscal health